By Jarred, Gilmore & Phillips, PA CPA Firm

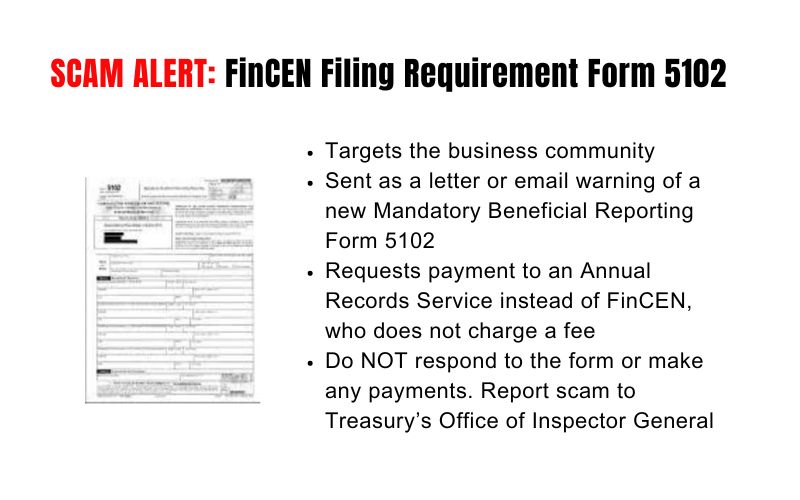

CHANUTE, Kan. — The local CPA firm of Jarred, Gilmore & Phillips, PA, would like to warn the business community of a scam that is currently circulating in the area. A business could receive either a letter or email which warns the business of a new Mandatory Beneficial Reporting Form 5102. This is a scam, do not complete and file the Form 5102. Please see below:

The Form 5102 scam is a fraudulent request for Beneficial Ownership Information (BOI) that appears to come from the federal government:

- What it looks like

The form may be titled “Mandatory Beneficial Reporting Form” and appear to come from the “Annual Records Service” or “US Business Regulations Dept.”. It may include a barcode labeled “Internal Use Only”.

- What it asks for

The form requests business information and payment of a filing fee. The form may include threatening language about penalties of perjury.

- What to do

Do not respond to the form or make any payments. You can report the scam to the Treasury’s Office of Inspector General.

#scamoftheweek Yes, Form 5102 is part of a phishing scam that requests payment to an Annual Records Service instead of FinCEN, who does not charge a fee.

The above scam should not be confused with the new filing requirement described below:

Starting in 2024, most registered businesses (LLCs and corporations) are required to file a new form called a BOI report, which is to report information about the company’s owners and must be filed with FinCEN. Beneficial Ownership Information (BOI) reporting is not an IRS program; all inquiries and filings must be directed to FinCEN, which is a bureau of the U.S. Department of the Treasury.

Qualifying entities that existed before 2024 have until the end of 2024 to file their BOI report.

All changes must be filed within 30 days, such as change of ownership or address changes.

Penalties for not filing the BOI report on time are up to $500 per day. This is not a filing you want to procrastinate on or not worry about.

If you would like the firm of Jarred, Gilmore & Phillips, PA, to file this report for your entity (or multiple entities if applicable), please contact our firm and then we will prepare and submit the BOI report to FinCEN for you. The total cost that you would be invoiced is approximately $150-$200 per entity. We will need to send you an engagement letter and an e-file authorization form to sign and return to our office. We will also need to have copies of driver’s licenses to upload with the BOI report. The driver’s licenses can be emailed or you can text pictures to our firm number 620-365-3125.

Or, if you would like, you can prepare and submit the form to FinCEN yourself. Here is the link if you choose to file your own BOI report: https://www.fincen.gov/boi.

Please respond as soon as possible if you would like to engage our firm to file this BOI filing.